Banking Communication Solutions

The banking sector refers to the broad category of financial services and operations provided by banks and other financial institutions. It encompasses a wide range of activities, from deposit services to lending, investment management, and risk management. The banking sector plays a crucial role in the economy by facilitating the flow of money, offering financial products, and providing essential services to individuals, businesses, and governments.

Transforming Banking Communication with Advanced Solutions

In today’s rapidly evolving financial landscape, seamless & secure communication is critical for banking institutions. Banking Communication Solutions empower banks to enhance customer interactions, streamline processes, & maintain compliance with regulatory standards. Leveraging cloud-based technologies, these solutions optimize call management, automate workflows, & ensure data security, delivering an exceptional customer experience while improving operational efficiency.

Key Features of Banking Communication Solutions

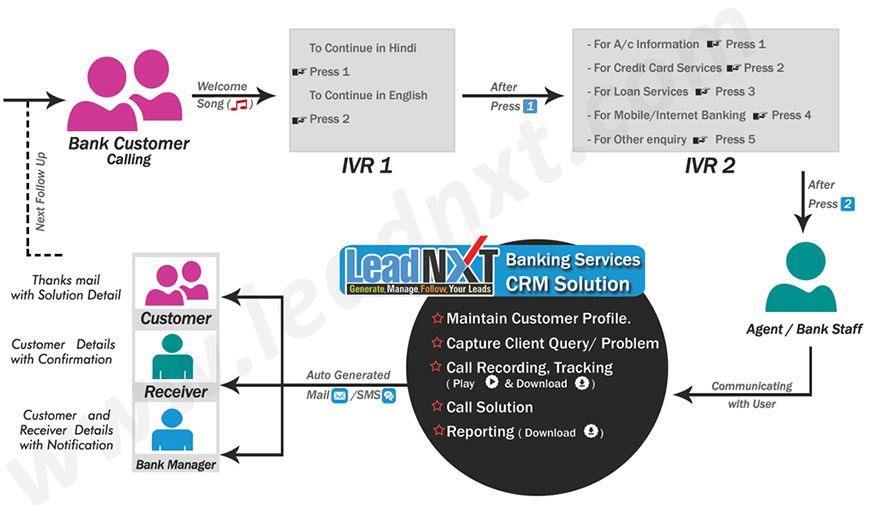

1. IVR Systems for Seamless Self-Service

Interactive Voice Response (IVR) systems revolutionize banking communication by enabling automated, self-service options for customers. With advanced IVR technology, banks can:

Automate routine inquiries like account balance checks & transaction status.

Direct calls to the appropriate departments for quicker resolutions.

Provide 24/7 assistance, reducing wait times & improving customer satisfaction.

Enhance security with voice authentication for account access.

Deliver multilingual support to cater to diverse customer demographics.

2. Call Tracking for Enhanced Customer Insights

Effective call tracking allows banks to monitor & analyze customer interactions. By leveraging call tracking solutions, financial institutions can:

Record & analyze customer queries to enhance service quality.

Identify common pain points & optimize support strategies.

Track marketing campaign effectiveness by monitoring inbound calls.

Improve fraud detection through call pattern analysis.

Gain real-time insights to enhance service personalization.

3. CRM Integration for Personalized Banking

A robust CRM integration ensures a seamless customer experience by consolidating customer data & communication history. With CRM-integrated communication solutions, banks can:

Personalize interactions based on customer history & preferences.

Improve lead management & customer retention strategies.

Automate follow-ups, ensuring timely responses & engagement.

Streamline loan processing with automated documentation tracking.

Enable seamless omnichannel communication across all touchpoints.

4. Secure Cloud-Based Communication

Security & compliance are paramount in banking communications. Cloud-based solutions provide:

End-to-end encryption to protect sensitive financial data.

Automated backups & disaster recovery for data security.

Compliance with banking regulations & industry standards.

Scalable infrastructure to handle growing banking communication needs.

AI-driven threat detection & fraud prevention capabilities.

5. Omnichannel Communication for Customer Convenience

Modern banking customers expect seamless communication across multiple channels. An omnichannel approach ensures consistent & efficient interactions through:

Voice calls & IVR systems for immediate assistance.

SMS & email notifications for transaction updates & alerts.

Chatbots & AI-driven messaging for real-time support.

Social media integration for customer engagement & issue resolution.

Video conferencing for personalized financial consultations.

Benefits of Implementing Banking Communication Solutions

Enhanced Customer Experience

By automating routine tasks & enabling seamless interactions, banking communication solutions significantly enhance customer satisfaction. Customers receive prompt responses, personalized service, & access to financial services anytime, anywhere. Self-service options reduce frustration & improve accessibility for all users.

Operational Efficiency & Cost Savings

Automation & AI-driven solutions minimize manual efforts, reducing operational costs. IVR systems & self-service options decrease the workload on support teams, allowing staff to focus on complex customer needs. Real-time analytics ensure resource optimization & improved decision-making.

Regulatory Compliance & Data Security

With stringent financial regulations, banks must ensure compliance with data protection laws. Cloud-based communication solutions provide robust security features, ensuring encrypted transactions & secure data storage. Advanced security mechanisms prevent data breaches, ensuring customers’ financial safety.

Scalability & Future-Readiness

As banks expand their services, scalable communication solutions accommodate growing customer demands. Cloud integration allows seamless upgrades, ensuring institutions remain competitive & future-ready. The integration of AI-driven automation enables predictive customer service, enhancing operational agility.

Better Fraud Prevention & Risk Management

Banking communication solutions contribute significantly to fraud detection & risk management. Real-time monitoring & AI-powered fraud analytics help identify suspicious activities, enabling proactive risk mitigation. Secure communication channels reduce the risk of data leaks & cyber threats.

Choosing the Right Banking Communication Solution

Selecting an advanced banking communication solution requires evaluating key factors such as:

Security & Compliance: Ensuring end-to-end encryption & regulatory adherence.

Integration Capabilities: Seamless CRM & core banking system integration.

Automation & AI Features: Enhancing customer support & efficiency.

Omnichannel Support: Providing a unified communication experience.

Scalability & Customization: Adapting to the evolving needs of the banking sector.

Conclusion

Banking Communication Solutions empower financial institutions with secure, efficient, & customer-centric communication tools. From IVR systems & call tracking to CRM integration & omnichannel support, these solutions drive operational efficiency & customer engagement while ensuring regulatory compliance. Implementing advanced communication technologies is essential for banks to stay competitive & deliver superior customer experiences in the digital era. By investing in innovative solutions, financial institutions can build trust, enhance security, & provide seamless banking interactions for their customers.